A partner in you should use the form and these instructions to determine the proper amounts to include on your Form IT-2041 on an aggregate basis see Form IT-204-I Instructions for Form IT-204 page 15 Partnerships instructions for Form IT-2041 and on any Form IT-204-CP you complete for a partner of your own see. Failure to furnish Estimate Tax Payable Form CP204 - Liable to a fine ranging from RM200 to RM2000 or face imprisonment or both.

Deferment Of Cp204 Payment Budget 2022

All businesses are allowed to revise their income tax estimates in the 11 th month of the basis period before 31 October 2022 and.

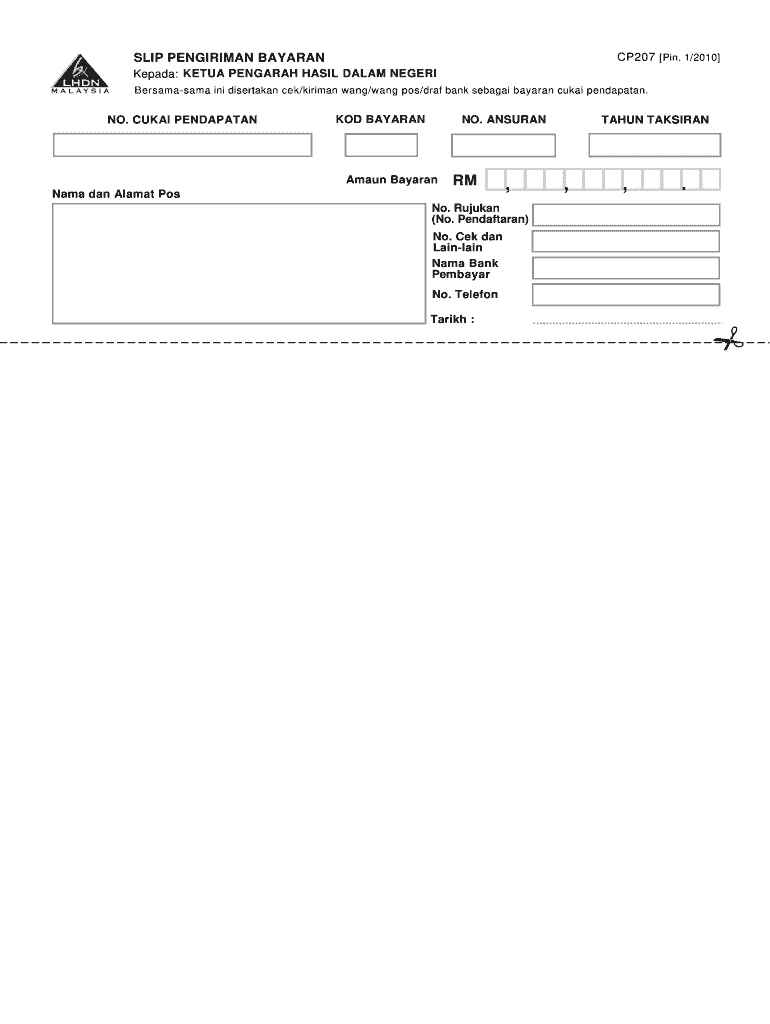

. ANGGARAN CUKAI YANG KENA DIBAYAR OLEH SYARIKAT PERKONGSIAN LIABILITI TERHAD BADAN AMANAH KOPERASI No. Therefore it is now able to revise its estimate in the month of the third instalment April without having to wait. Find Forms for Your Industry in Minutes.

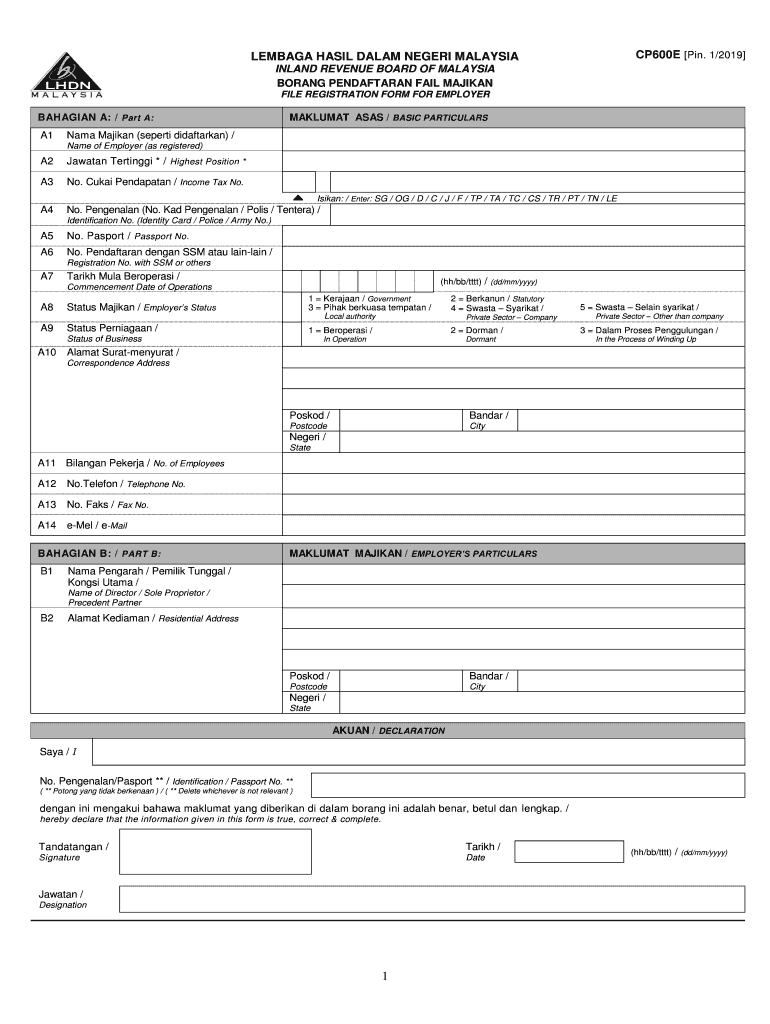

LLP is Limited Liability Partnership. In Budget 2022 it was announced that. Some thought CP204 is for SDN BHD only.

Grace period is given until 15 May 2019 for the e-Filing of Form BE Form e-BE for Year of Assessment 2018. LEMBAGA HASIL DALAM NEGERI MALAYSIA Jabatan Pemprosesan Makumat Menara Hasil No3 Jalan 910 Seksyen 9 Karung Berkunci 206. Streamlined Document Workflows for Any Industry.

Easy Fast Secure. Do Your 2021 2020 any past year return online Past Tax Free to Try. Microenterprises and small and medium.

The equal monthly instalments begins from the 6th month in the basis period for the YA 2019 ie September 2019 until May 2020. Many LLP partners are not aware the tax compliance requirement for LLP. Ad Make Your Free Legal Documents.

C own shares real properties fixed deposits and other similar investments are not. Create Legal Documents Using Our Clear Step-By-Step Process. Easy Fast Secure.

NOTA PENERANGAN BORANG CP204 ANGGARAN CUKAI YANG KENA DIBAYAR OLEH SYARIKAT PERKONGSIAN LIABILITI TERHAD KOPERASI BADAN AMANAH a Borang CP204 Gunakan borang ini apabila membuat anggaran cukai yang kena dibayar. Borang CP204 Borang CP204 adalah anggaran cukai bentuk yang perlu dibayar oleh Badan Amanah Koperasi Syarikat. Submission of Form CP204 Pursuant to subsection 107C 7A of the ITA.

Download Form - Other Forms. The CP204 form was submitted on Nov 30 2019. Ad Do Your 2021 2020 2019 2018 Taxes in Mins Past Tax Free to Try.

The penalty after the Form J is issued under subsection 90 3 is for failure to submit ITRF gagal mengemukakan borang nyata and the rate is fixed at 45 refer point 4 of the GPHDN 52019. Failure to pay the monthly tax estimation by the 15th of the month a 10 penalty will be imposed on. Trust bodies cooperatives and Limited Liability Partnerships LLPs are required to submit Form CP204 by e-Filing from the Year of Assessment 2019.

Co-operative Beribu Bintang has to furnish Form CP204 for YA 2019 not later than 3062019 which is 3 months from the date of commencement of its business operations. Submission period of e-CP204 Form. Isi ruangan dengan HURUF BESAR menggunakan pen dakwat hitam.

The Operational Guidelines 52019. - Section 120 1 f Fails to pay the monthly tax estimate instalment by 15th of the month a late payment penalty of 10 will be imposed on the balance of tax instalment not paid for the month - Section 107C 9. Failure to submit tax estimation liability Form CP204 will be subject to a fine of RM200 to RM2000 or imprisonment or both.

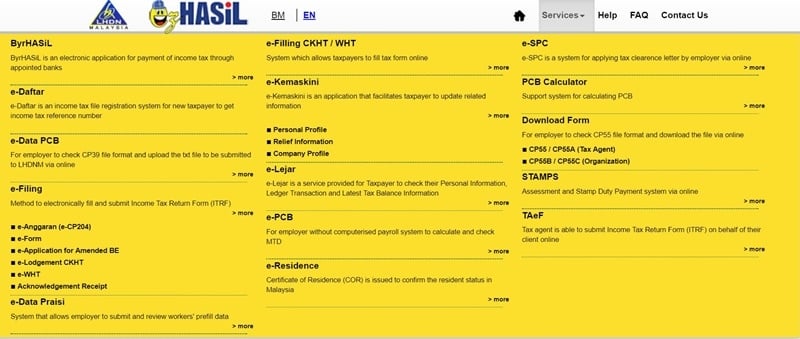

Companies are required to submit Form CP204 by e-Filing from the Year of Assessment 2018. Apply e-Filing Organisasi from LHDN using Form CP55B 2019 May need to attac. 1 Go to Setup Employees Employees 2 Click on the CP38 button 3 Either Search for an employee code or employee name 4 Select the corresponding year and key-in the amount based on the month accordingly.

Twelve instalments of RM1000 each are payable from Feb 15 2020 until Jan 15 2021. Get Started On Any Device. Have not commenced operation need not furnish Form CP204.

The impact of Covid-19 is such that the company now estimates its tax liability to be RM7500. Ad State-specific Legal Forms Form Packages for Government Services. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor.

Tax treatment for SDN BHD and LLP are almost identical in many aspect thus for CP204 tax estimate they. FAQs on the revision of estimate of tax payable in the 11 th month of the basis period and the deferment of CP204 and CP500 payments. If a taxpayer furnished his Form e-BE for Year of Assessment 2018 on 16 May 2019 the.

Headquarters of Inland Revenue Board Of Malaysia.

Cp204 Form Fill Online Printable Fillable Blank Pdffiller

Deferment Of Cp204 Payment Budget 2022

Cp204 Form Fill Online Printable Fillable Blank Pdffiller

Cp204 Form Fill Online Printable Fillable Blank Pdffiller

Deferment Of Cp204 Payment Budget 2022

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

How To Submit Income Tax 2019 Through E Filing Lhdn Malaysia

Taxplanning Tax Measures Announced During The Mco The Edge Markets

Cp204 Form Fill Online Printable Fillable Blank Pdffiller

What Is Cp204 Cp204 Vs Cp204a Sql Payroll

What Is Cp204 Cp204 Vs Cp204a Sql Payroll

Deferment Of Cp204 Cp500 Payment Budget 2022

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Cp207 Fill Online Printable Fillable Blank Pdffiller

2019 2022 Form My Cp600e Fill Online Printable Fillable Blank Pdffiller